PCI Secure Software Framework

The PCI Software Security Framework (SSF) represents a fusion of both classical and contemporary software security prerequisites.

Simplified solutions.

The PCI Software Security Framework (SSF) represents a fusion of both classical and contemporary software security prerequisites.

The PCI SSF encompasses an array of standards and initiatives dedicated to fostering the secure conception and crafting of payment software. This newly updated SSF comprises two integral components:

The Secure SLC Standard delineates a set of security prerequisites and corresponding evaluation procedures for software providers.These measures ensure the proper

management of payment software security throughout its life cycle, particularly for vendors that create software tailored for the payments industry.

Conversely, the Secure Software Standard outlines a series of security mandates and associated assessment procedures. These collectively guarantee that payment software adequately shields the integrity and confidentiality of payment transactions and associated data. This standard applies to payment software destined for sale, distribution, or licensing to third-party entities.

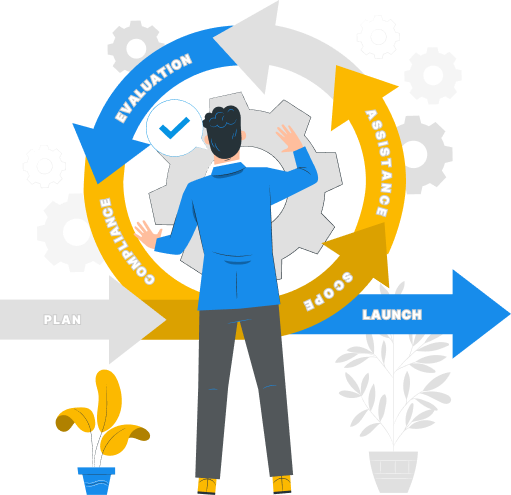

Initial Consultation: An initial discussion to establish primary points of contact from both organizations, set assessment timelines, outline high-level requirements, and create a project roadmap.

Scope Definition: Clearly define the boundaries of the assessment scope, taking into account any dependencies on third-party entities.

Gap Analysis: Conduct interviews, review documentation, and walkthrough processes to pinpoint areas of improvement and offer recommendations.

Remediation and Advisory Assistance: Act as partners in providing guidance and support in rectifying identified gaps and in collecting necessary evidence.

Preliminary Evaluation : Following a suitable incubation period, a specialized team of experts undertakes an initial assessment of your setup

Compliance Certification Process: Execute the certification phase, and upon successful completion, furnish reports and attestation documentation or certification. Additionally, assist the client in listing payment application details with the PCI SSC.

Ongoing Assistance: Through our Managed Compliance Services, we offer continuous support to ensure your continued compliance.

Industry experts -Consultants in the team have experience leading PCI programmes for biggest corporations, that is used by the biggest banks in the world.

In average we have 15+ years of hands on experience as well as technical knowledge to coach developers, architects to implement PCI security controls.

Unbiased Provider – We strive to be your genuine consulting and audit partner, refraining from selling hardware or software to maintain impartiality.

Comprehensive Assistance – Our team will guide you through every step of the Compliance process, from designing controls to preparing necessary documentation.

Flexible engagement model by embedding Simplified Solutions consultant as part of your organization or ours.