PCI DSS 4.0

The PCI DSS (Payment Card Industry Data Security Standard) is an information security standard designed to reduce payment card fraud by increasing security controls around cardholder data.

Simplified solutions.

The PCI DSS (Payment Card Industry Data Security Standard) is an information security standard designed to reduce payment card fraud by increasing security controls around cardholder data.

Governance

Advisory

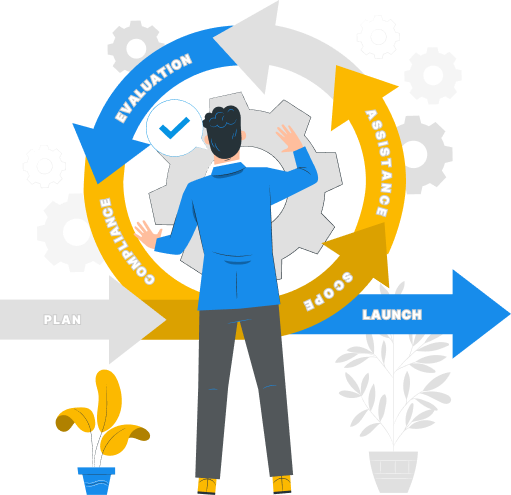

Initial Consultation: An initial discussion to establish primary points of contact from both organizations, set assessment timelines, outline high-level requirements, and create a project roadmap.

Scope Definition: Clearly define the boundaries of the assessment scope, taking into account any dependencies on third-party entities.

Gap Analysis: Conduct interviews, review documentation, and walkthrough processes to pinpoint areas of improvement and offer recommendations.

Remediation and Advisory Assistance: Act as partners in providing guidance and support in rectifying identified gaps and in collecting necessary evidence.

Preliminary Evaluation : Following a suitable incubation period, a specialized team of experts undertakes an initial assessment of your setup

Compliance Certification Process: Execute the certification phase, and upon successful completion, furnish reports and attestation documentation or certification. Additionally, assist the client in listing payment application details with the PCI SSC.

Ongoing Assistance: Through our Managed Compliance Services, we offer continuous support to ensure your continued compliance.

Build and Maintain a Secure Network and Systems

1. Install and Maintain Network Security Controls.

2. Apply Secure Configurations to All System Components.

Protect Account Data

3. Protect Stored Account Data.

4. Protect Cardholder Data with Strong Cryptography During Transmission Over Open, Public Networks.

Maintain a Vulnerability Management Program

5. Protect All Systems and Networks from Malicious Software.

6. Develop and Maintain Secure Systems and Software.

Implement Strong Access Control Measures

7. Restrict Access to System Components and Cardholder Data by Business Need to Know.

8. Identify Users and Authenticate Access to System Components.

9. Restrict Physical Access to Cardholder Data.

Regularly Monitor and Test Networks

10. Log and Monitor All Access to System Components and Cardholder Data.

11. Test Security of Systems and Networks Regularly.

Maintain an Information Security Policy

12. Support Information Security with Organizational Policies and Programs.